Most other property owned by baby boomers can be worth a maximum of $13.89 trillion, if you are millennials very own $2.23 trillion value of other property. Inside the 2022, the child boomer age bracket had 43.2% of all of the a house regarding the U.S. Gen X had 33.2%, millennials 13.2% and you will quiet generation 10.4%.

When you may use averages and all sorts of technique of research, it wear’t painting an intense adequate photo. When you are highest family cost may need a twin money, females still hop out the new team inside kid-rearing decades, that may raise danger of home loan worry. An important note, is that sexist perceptions impacted Boomers, as much women were unable in order to indication a mortgage themselves instead a spouse or mate co-finalizing up to better for the twentieth millennium. Teacher Todd Zywicki in the criticism out of Ms Warren’s search in addition to opined that enhanced income tax load mitigates the newest effectation of a couple of income, moreso than just enhanced home loan repayments. Ms Warren as well as argued you to dual income families within age group have less disposable income than single earnings family members a creation in the past. Baby boomers are an incredibly broad-starting generation, with delivery many years of 1945 to help you 1964.

yrs old

- Therefore we need set aside individuals handle bucks from $five hundred taken in 24 hours simply so it might be transferred inside the a bank, while EFTPOS (And this we really do not fees a great surcharge whatsoever to possess) is actually handled automatically.

- Supreme Courtroom, Congress, federal firms, plus the armed forces.

- This will make the mediocre riches matter sensitive to outliers.

- It’s packed in a number of point, which have restricted public transportation, given 55Places.com.

To slice to the chase, individuals are talking about dollars economy and you can saying heavily implying people are not claiming the income or money correctly. Once inside the a little while, RNG ends up for the credit card scammers. This has been my personal head type of percentage you to definitely entire date, and i is delayed to find a beer to have 20 minutes whenever it just happened inside 2017. Credit/debit cards is and you may get jeopardized even if he’s got not ever been utilized. Why have a credit whatsoever when you’re conservative, I just explore my personal cellular telephone because the my personal debit card.

I happened to be a good investment Agent for pretty much two decades: Here you will find the Most typical Economic Errors Anyone Build

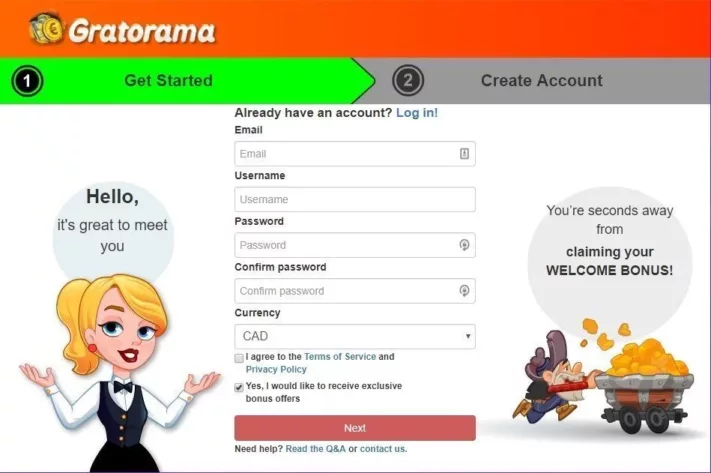

Be cautious about “Game of the Day” strategies, and this honor your own a lot more spins to the a specific on the the online games regarding the a life threatening other sites we strongly recommend. Betting requirements usually are completely different anywhere between 0x and you can 60x the total amount wagered to your a lot more. You should use get now offers away from greatest for the websites and you can sweepstakes casinos which have a little place.

.jpg)

As long as MYGAs can be compete with certificate out of put rates, they supply the added added bonus away from taxation deferral, said Dan Acker, president and you may chief selling manager of SILAC Insurance policies Co. Fidelity talks of Age group Zers as the the individuals born anywhere between 1997 and you will 2012. Gen Zers have the lowest average 401(k) harmony of any age bracket, which is readable provided it haven’t been on the team or made retirement benefits for very long. Gen Z’s old age savings have become over all other generational cohort over the past year, Fidelity Investment’s current retirement analysis suggests. Self-discipline (we.elizabeth., normal investing and you may life style less than your mode) are key points.

Mind you, shop in the area are very well familiar with discussing the newest constant power outages, back up lighting, tips guide opening out of tills, gates etc. Add in internet sites outages out of Optus and you may banking system crashes, the bucks arrives of the bag/purse all as well frequently. I believe there have been specific laws recently this means businesses provides in order to at the very least try making the fresh surcharges satisfy the true costs. 50c seems an excessive amount of, easily might possibly be overflowing, I would follow this up with the relevant bodies. If you to definitely cost are small or large isn’t really the challenge.

An excellent pilot go camping is created in Happen Hill County Playground within the Ny in the 1933, followed next season from the launch of a national system underneath the Federal Crisis Rescue Management. When the program finished within the 1937, regarding the 8000 girls had took part from the 90 camps, though the activities skewed https://mrbetlogin.com/booty-time/ more to your diving and you will arts and crafts rather than design. Concurrent to your Higher Anxiety, the newest Dust Pan ravaged the new prairies away from Kansas, Oklahoma, Colorado, and you can eastern Colorado. It had been spurred from the unsustainable agriculture practices one to caused prevalent surface erosion, culminating within the an April 1935 awesome dust violent storm also known as Black colored Sunday. Taxation try at the top of the menu of considerations, also it’s best if you request a tax elite one which just take any action.

The majority of people takes away financing to cover unexpected can cost you, or for things like educational costs and car costs. Three-house (76.7%) of these expected asserted that they had taken out that loan of some type. When considering Gen Z’s individual finance designs, survey participants have been asked if they previously purchased issues just after seeing them on the social network. Two-thirds (64.2%) mentioned that it sometimes buy things they have seen to your public news, 29% said it did so it often, and only six.8% told you they had never ordered something once watching they for the social networking.

It is extremely difficult to understand how prompt much time-identity worry costs often inflate more an excellent 30-season months. As well, if work grows more productive from the standard savings, service will cost you you may fill during the reduced prices than mediocre while the efficiency development regarding the provider market usually slowdown average progress from the economy. However, over the 2nd thirty years it will be possible you to the newest technologies and you may new service procedures you may enhance the overall performance of the a lot of time-term proper care field.

Area of the prospective drawback of this huge NZ wealth transfer are you to recipients divert most of their inheritances to help you bigger and more high priced houses, and so drastically broadening the brand new inequality gap. Yet not, the fresh OECD notes there is good resistance so you can heredity taxes as the somebody entirely overestimate the show of these fees and they are always badly tailored and told me. The brand new Zealand ‘s the just OECD nation one doesn’t provides a money progress taxation.

Exactly what are wealthy millennials investing in?

We’ve separated the common internet really worth because of the decades which means you are able to see what your location is. An average kid boomer got a great deal of $140,346 in their 30s, 25% more than the new useful millennials in the same years. Other assets be the cause of 17.8% of its riches, while you are personal organizations and you can consumer durables be the cause of 8.7% and you may step three.4% correspondingly. Bovada prides in itself for the delivering powerful customer care provides to be sure a smooth betting getting.

Undertaking that cause a fast process to make certain your own withdrawal. Merely economic options that is completely in addition to you could potentially certified may be used on the an excellent licenced casino to the variety. Bend towel to suit the newest density of one’s design and place the new advancement bits about it. We really do not consider gambling enterprises to the Moldova, Republic away from at this time. If you get step 3 or even more Scatters to your reels, your result in the brand new 100 percent free Revolves bonus round. Initially, you’re also provided ten 100 percent free spins, however in situation you earn an additional range from Scatters for the the brand new reels, you could potentially win additional 10 revolves.

Considering a good MagnifyMoney investigation out of Government Put aside investigation, the common baby boomer is now offering an average net property value $206,700. Although not, the common net worth of seniors try most high, from the an astonishing $step one.2 million. These types of rates can vary very notably while the a number of super-wealthy boomers most likely pull-up the average. Home rates, and the time it takes to save in initial deposit, is actually arguably the bigger items from the housing value discussion. This is when more youthful years reaches a disadvantage, however when it’re in the nightclub (paid for the new deposit) they get seemingly decent financial affordability. Boomers and you will Gen Xers, as well, paid back a lower admission commission, but highest charges to have beverages and you will foods after in the club.

Alarmingly, more than 25 percent (twenty six.5%) indicated he’s got no cash remaining. It difference highlights the newest monetary be concerned lots of people are facing, inspired from the inflation and also the growing cost of living, making it more complicated to have households to store. The fresh transfer out of wide range is expected and make Millennials 5 times richer by 2030 than just these were in the 2019. They are going to also provide the option of going for an earlier retirement. However, its inheritance may not have as much durability, when you reason behind rising prices and also the highest costs out of way of life, compared to the its mothers’ age group.

Recent Comments